Invest in Stocks Market Basics for New Investors

Investing in the stocks market can seem intimidating for newcomers, but with the right knowledge and approach, anyone can start building wealth through stock investments. The key is to understand the fundamental principles and develop a strategic mindset.

Exploring the Foundations of Stock Investing

When you purchase stocks, you’re essentially buying a small piece of ownership in a company. This ownership represents a share of the company’s assets and potential future earnings. The stock market provides an opportunity for individual investors to participate in the financial growth of businesses across various industries.

Essential Steps for New Investors

- Research and educate yourself about different investment strategies

- Assess your personal financial goals and risk tolerance

- Start with a solid understanding of basic financial concepts

- Create a diversified investment portfolio

Types of Investment Approaches

Investors typically choose between two primary investment strategies:

Long-Term Investing

This approach involves purchasing stocks with the intention of holding them for extended periods, typically years or even decades. Long-term investors focus on companies with strong fundamentals, consistent growth potential, and stable financial performance.

Short-Term Trading

Short-term traders aim to capitalize on market fluctuations by buying and selling stocks within shorter time frames. This strategy requires more active management and a deeper understanding of market dynamics.

Key Considerations Before Investing

- Understand your financial situation and investment capacity

- Set clear investment objectives

- Develop a realistic budget for investing

- Learn to manage potential risks

Analyzing Stock Performance

Successful investors learn to evaluate stocks using multiple metrics and indicators. Critical factors to consider include:

- Price-to-earnings (P/E) ratio

- Company financial statements

- Historical stock performance

- Industry trends and market conditions

Risk Management Strategies

Minimizing potential losses is crucial for new investors. Implementing a diversification strategy helps spread risk across multiple investments. This means avoiding concentration in a single stock or sector, which can expose you to significant financial vulnerability.

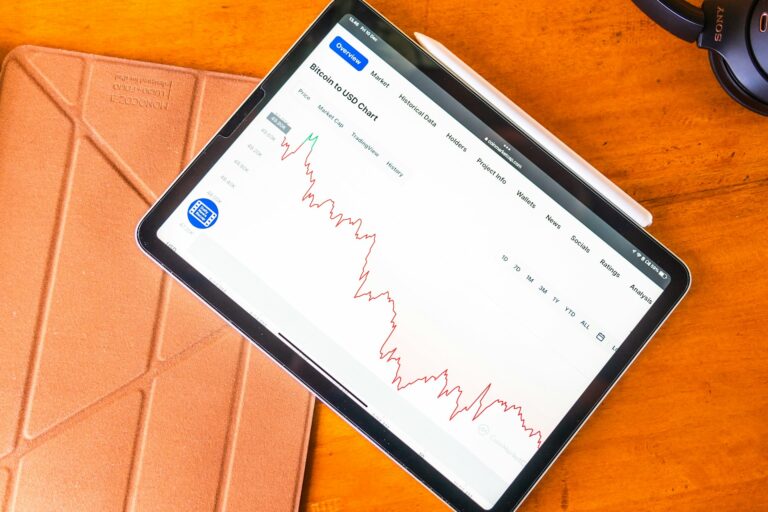

Technology and Investment Tools

Modern investors have access to numerous online platforms and mobile applications that simplify the investment process. These tools provide real-time market data, research resources, and trading capabilities, making it easier for beginners to start their investment journey.

Building Your Investment Knowledge

Continuous learning is essential in the world of stock investing. Consider exploring educational resources such as:

- Online investment courses

- Financial blogs and podcasts

- Investment books by renowned experts

- Webinars and financial workshops

Recommended Initial Investment Approach

For beginners, starting with low-cost index funds or exchange-traded funds (ETFs) can provide a solid foundation. These investment vehicles offer broad market exposure and typically have lower risk compared to individual stock selections.

Financial Preparation

Before diving into stock investments, ensure you have an emergency fund and have addressed high-interest debt. This financial preparation creates a stable platform for your investment journey and reduces potential financial stress.

Remember that successful investing requires patience, discipline, and a willingness to learn. While the stock market offers potential for significant returns, it also comes with inherent risks. Always approach investing with a strategic mindset and be prepared to adapt your strategy as you gain more experience.

Developing a Strategic Investment Portfolio

Understanding Portfolio Diversification

Strategic investment begins with understanding the core principle of diversification. This means spreading your investments across various asset classes to minimize risk and optimize potential returns. By allocating funds across different sectors, geographic regions, and investment types, you create a safety net that protects your capital from market volatility.

Key diversification strategies include:

- Mixing stocks from different industries

- Including bonds and fixed-income securities

- Exploring international market opportunities

- Considering alternative investments like real estate or commodities

Asset Allocation Principles

Determining the right asset allocation depends on multiple factors, including your age, financial goals, risk tolerance, and investment timeline. Younger investors can typically afford more aggressive strategies with higher stock exposure, while those closer to retirement might prefer more conservative approaches with increased bond allocations.

Risk Assessment Framework

Evaluating your personal risk tolerance involves honest self-reflection about your financial comfort zone. Consider these critical questions:

- How much potential loss can you emotionally and financially withstand?

- What are your short-term and long-term financial objectives?

- Do you have emergency savings to support potential investment fluctuations?

Investment Vehicle Selection

Modern investors have numerous options for building their portfolio. Exchange-traded funds (ETFs), mutual funds, individual stocks, and index funds each offer unique advantages. ETFs provide low-cost, diversified exposure, while individual stocks allow more targeted investment strategies.

Performance Tracking Mechanisms

Regular portfolio monitoring is crucial for maintaining optimal performance. Implement a systematic review process that includes:

– Quarterly performance assessment

– Annual rebalancing

– Tracking individual asset performance

– Comparing portfolio returns against benchmark indices

Risk Management Techniques

Effective risk management goes beyond diversification. Consider implementing stop-loss orders, setting investment limits, and maintaining a balanced approach to potential high-risk investments. Professional investors often recommend limiting speculative investments to no more than 10% of your total portfolio.

Technology-Driven Investment Strategies

Leverage modern technological tools that can help optimize your investment approach:

- Robo-advisors for automated portfolio management

- Advanced screening tools for stock selection

- Real-time market analysis platforms

- Mobile apps for continuous portfolio tracking

Continuous Learning and Adaptation

The investment landscape constantly evolves, making continuous education essential. Stay informed about market trends, economic indicators, and emerging investment opportunities. Subscribe to reputable financial publications, attend webinars, and consider consulting with financial advisors who can provide personalized guidance.

Tax-Efficient Investment Strategies

Minimize tax liability by understanding tax-efficient investment approaches. Utilize tax-advantaged accounts like 401(k)s and IRAs, and consider the tax implications of your investment decisions. Long-term capital gains often receive more favorable tax treatment compared to short-term trading.

Financial Goal Alignment

Your investment portfolio should ultimately reflect your broader financial objectives. Whether saving for retirement, purchasing a home, or funding educational expenses, ensure your investment strategy directly supports these goals. Regularly reassess and adjust your approach as your life circumstances change.

By implementing these strategic principles, investors can develop a robust, adaptable portfolio designed to navigate complex market dynamics while working towards long-term financial success.

Risk Management and Diversification Techniques

When diving into stock market investments, understanding how to manage risk and create a well-balanced portfolio is crucial for long-term financial success. Investors must develop strategic approaches that protect their capital while maximizing potential returns.

Understanding Portfolio Balance

Effective investment strategies revolve around spreading your financial resources across multiple asset classes and sectors. By allocating investments strategically, you reduce the potential impact of poor performance in any single investment area.

Key Diversification Principles

- Invest across different market sectors

- Balance between high-risk and low-risk investments

- Consider geographical market variations

- Mix asset types including stocks, bonds, and mutual funds

Calculating Investment Risk Tolerance

Your personal risk tolerance depends on several critical factors, including age, financial goals, income stability, and overall economic circumstances. Younger investors typically can afford more aggressive investment strategies, while those closer to retirement might prefer more conservative approaches.

Risk Assessment Framework

| Risk Level | Recommended Portfolio Allocation | Investment Strategy |

|---|---|---|

| Conservative | 70-80% Low-Risk Assets | Stability-focused investments |

| Moderate | 50-60% Balanced Assets | Mixed growth and stability |

| Aggressive | 60-70% High-Growth Stocks | Maximum potential returns |

Advanced Diversification Techniques

Professional investors utilize sophisticated methods to minimize potential losses and optimize portfolio performance. This includes implementing hedging strategies, using options contracts, and continuously monitoring market trends.

Strategic Investment Approaches

- Implement dollar-cost averaging

- Regularly rebalance investment portfolios

- Use index funds for broad market exposure

- Monitor correlation between different investments

Modern Portfolio Theory Application

Developed by Harry Markowitz, this investment approach emphasizes creating portfolios that maximize expected returns for a given level of risk. Investors can leverage mathematical models to optimize asset allocation and minimize potential volatility.

Essential Risk Mitigation Strategies

- Conduct thorough research before investing

- Set clear investment objectives

- Create emergency financial reserves

- Stay informed about market developments

- Consider professional financial advice

Technology-Driven Risk Management

Modern investment platforms and analytical tools provide sophisticated risk assessment capabilities. These technologies enable investors to track portfolio performance, analyze potential scenarios, and make data-driven decisions in real-time.

Emerging Investment Technologies

- AI-powered investment algorithms

- Automated portfolio rebalancing tools

- Advanced risk simulation software

- Machine learning predictive models

Successfully managing investment risks requires continuous learning, adaptability, and a disciplined approach. By implementing comprehensive diversification strategies and maintaining a balanced perspective, investors can navigate market complexities and work towards achieving their financial goals.

Essential Research and Analysis Tools for Stock Selection

When diving into stock investing, having the right research and analysis tools can make a significant difference in your investment strategy. Successful investors rely on a comprehensive set of resources to make informed decisions and maximize their potential returns.

Financial Websites and Screening Platforms

Investors can leverage powerful online platforms that provide in-depth financial information. Websites like Yahoo Finance, Google Finance, and Finviz offer robust screening tools that allow you to filter stocks based on multiple criteria. These platforms enable you to:

- Compare financial ratios

- Analyze company fundamentals

- Track real-time stock performance

- Explore historical price data

Advanced Screener Capabilities

Professional-grade screening tools like Seeking Alpha and Morningstar provide more sophisticated filtering options. Investors can create custom screens using parameters such as:

- Market capitalization

- Price-to-earnings ratio

- Dividend yield

- Revenue growth

- Debt-to-equity ratio

Fundamental Analysis Tools

Understanding a company’s financial health requires deep analytical capabilities. Professional investors utilize comprehensive tools that offer:

- Detailed financial statement analysis

- Quarterly and annual report breakdowns

- Comparative industry performance metrics

- Earnings call transcripts and insights

Key Financial Metrics to Examine

Investors should focus on critical financial indicators that reveal a company’s true performance:

- Operating margin

- Return on equity

- Free cash flow

- Debt coverage ratios

- Earnings per share trends

Technical Analysis Software

Technical traders rely on specialized software to identify market trends and potential investment opportunities. Platforms like TradingView and MetaStock offer advanced charting capabilities that help investors:

- Identify price patterns

- Generate trading signals

- Create custom indicators

- Backtest investment strategies

Chart Analysis Techniques

Professional investors use multiple technical indicators to make informed decisions:

- Moving averages

- Relative strength index (RSI)

- Bollinger Bands

- Support and resistance levels

Real-Time Data and News Integration

Staying informed about market movements requires access to up-to-the-minute information. Comprehensive research tools now integrate:

- Live market data

- Breaking financial news

- Analyst recommendations

- Global economic indicators

Professional Information Sources

Reliable information sources include:

- Bloomberg Terminal

- Reuters

- Wall Street Journal

- Financial Times

Risk Management Tools

Successful investing involves understanding and mitigating potential risks. Advanced tools help investors:

- Assess portfolio diversification

- Calculate potential volatility

- Evaluate correlation between assets

- Simulate potential market scenarios

Portfolio Optimization Strategies

Modern tools enable investors to:

- Stress test investment portfolios

- Model different economic scenarios

- Optimize asset allocation

- Manage overall investment risk

Machine Learning and AI-Powered Analysis

Cutting-edge research platforms now incorporate artificial intelligence to provide predictive insights. These advanced tools can:

- Analyze massive datasets

- Predict potential market trends

- Identify complex investment patterns

- Generate sophisticated investment recommendations

Investors must remember that while these tools provide valuable insights, they should not replace personal research and due diligence. Combining multiple research methods and maintaining a disciplined approach is key to successful stock investing.

The investment landscape continues to evolve, with technology playing an increasingly significant role in helping investors make informed decisions. By leveraging these sophisticated research and analysis tools, individuals can develop more robust investment strategies and potentially improve their financial outcomes.

Building Long-Term Wealth Through Smart Stock Investing

Investing in stocks is a powerful strategy for growing your wealth over time. While the stock market can seem intimidating, understanding the fundamental principles can help you make smart investment decisions that build financial security.

Understanding Stock Market Basics

Stocks represent ownership in a company, allowing investors to participate in a business’s potential growth and success. When you purchase shares, you become a partial owner with the opportunity to benefit from the company’s performance through potential price appreciation and dividend payments.

Developing a Strategic Investment Approach

Successful long-term investing requires a disciplined and informed strategy. Consider these key principles to maximize your investment potential:

- Research potential companies thoroughly

- Diversify your investment portfolio

- Understand your risk tolerance

- Invest consistently over time

- Monitor but avoid emotional trading decisions

Risk Management Techniques

Minimizing risk is crucial in stock investing. Spreading your investments across different sectors and company sizes can help protect your portfolio from potential market volatility. Consider using index funds and exchange-traded funds (ETFs) to achieve broader market exposure with reduced individual stock risk.

Financial Education and Continuous Learning

The most successful investors continuously educate themselves about market trends, economic indicators, and company performance. Read financial publications, follow market news, and consider taking online courses to enhance your investment knowledge.

Investment Tools and Resources

Modern technology offers numerous tools to support your investment journey:

- Online brokerage platforms

- Investment tracking apps

- Financial analysis websites

- Robo-advisors for automated investing

Creating a Personal Investment Plan

Develop a personalized investment strategy that aligns with your financial goals. Consider factors like your age, income, risk tolerance, and long-term objectives. Young investors can typically afford more aggressive strategies, while those closer to retirement might prioritize more conservative approaches.

Recommended Initial Investment Strategies

| Age Group | Recommended Stock Allocation | Risk Level |

|---|---|---|

| 20-35 years | 80-90% stocks | High |

| 36-50 years | 60-70% stocks | Moderate |

| 51-65 years | 40-50% stocks | Low-Moderate |

Tax-Efficient Investing Strategies

Maximize your investment returns by understanding tax implications. Utilize tax-advantaged accounts like 401(k)s and IRAs to reduce your tax burden and potentially increase long-term gains.

Key Investment Principles

- Start investing early to leverage compound growth

- Reinvest dividends for additional portfolio expansion

- Maintain a long-term perspective

- Regularly rebalance your portfolio

Remember that successful stock investing is a marathon, not a sprint. Patience, discipline, and continuous learning are your greatest assets in building long-term wealth through strategic stock investments.

Conclusion

Embarking on your stock investment journey requires patience, continuous learning, and a disciplined approach. As you’ve discovered through exploring the fundamentals of stock market investing, success isn’t about overnight riches but strategic, informed decision-making. The key is to blend knowledge of market basics, portfolio construction, risk management, and thorough research into a cohesive investment strategy.

Beginners should remember that investing is a marathon, not a sprint. Your ability to remain calm during market fluctuations, consistently educate yourself, and adapt your strategies will ultimately determine your financial growth. By implementing diversification techniques and using robust research tools, you’ll develop the confidence to make sound investment choices.

Start small, invest regularly, and prioritize learning. Consider leveraging low-cost index funds and blue-chip stocks as foundational investments while gradually expanding your portfolio. Develop a long-term perspective that focuses on wealth accumulation rather than short-term gains. Technology and online platforms have made stock investing more accessible than ever, providing unprecedented opportunities for individual investors.

Financial success in stock investing isn’t about timing the market perfectly, but about time in the market. Commit to continuous learning, stay informed about economic trends, and maintain a balanced, diversified approach. Your investment journey is unique, and with dedication, strategic planning, and disciplined execution, you can build substantial wealth over time.

Remember, every seasoned investor started exactly where you are now – willing to learn and committed to growing their financial knowledge. Your first step today could be the beginning of a rewarding investment path that secures your financial future.

Read Also Real Estate vs. Stocks: Comprehensive Investment Comparison

Was this helpful?

Leave Feedback